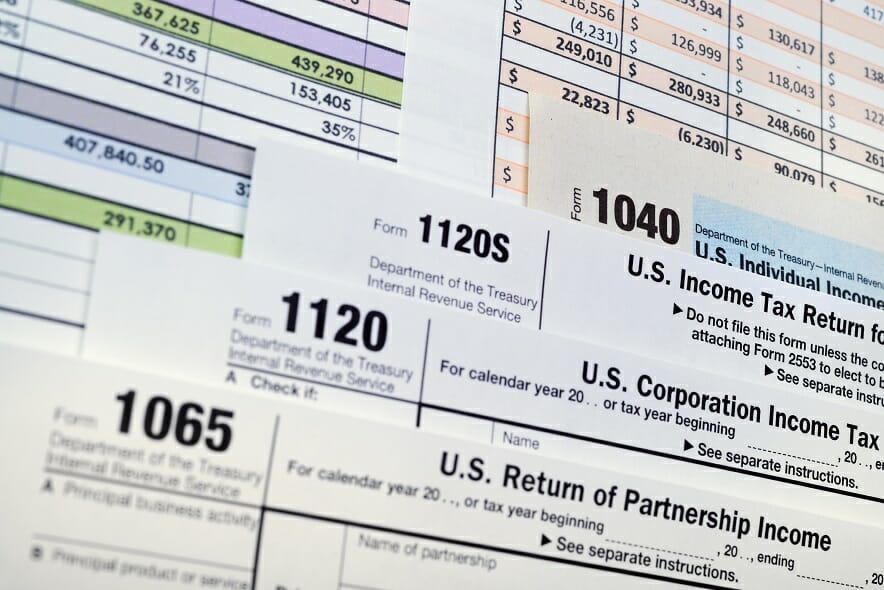

F/m Investments, Compoundr launch fixed-income ETFs to address dividend tax drag - Pensions & Investments

F/m Investments, in partnership with Compoundr, launched a suite a fixed-income ETFs that aim to solve the dividend tax drag.

Explore web search results related to this domain and discover relevant information.

F/m Investments, in partnership with Compoundr, launched a suite a fixed-income ETFs that aim to solve the dividend tax drag.

Depreciation. The amount of depreciation associated with a fixed asset is set in accordance with the depreciation method used, and is rarely altered until the end of the asset’s useful life. Property taxes. Property taxes are usually updated once a year or less frequently, depending on when the taxing authority elects to update its property tax database. When a company has a large fixed cost component, it must generate a significant amount of sales volume in order to have sufficient contribution margin to offset the fixed cost.A fixed cost is a cost that does not increase or decrease in conjunction with any activities. It must be paid by an organization on a recurring basis, even if there is no business activity. The amount charged to expense tends to change little from period to period.Once that sales level has been reached, however, this type of business generally has a relatively low variable cost per unit, and so can generate outsized profits above the breakeven level. An example of this situation is an oil refinery, which has massive fixed costs related to its refining capability.Conversely, if a company has low fixed costs, it probably has a high variable cost per unit. In this case, a business can earn a profit at very low volume levels, but does not earn outsized profits as sales increase.

Fixed costs are any business cost that stays constant regardless of factors like sales revenue and output. Some common fixed expenses for businesses include property tax, monthly rent, loan repayments, and insurance payments. A fixed cost is a business expense that remains unchanged, no matter how much a company grows its revenue or produces. Some examples of fixed costs may include insurance, rent, property taxes, and depreciation.Follow these steps to calculate your business’ fixed costs: Find all costs that remain unchanging from month to month, like your rent, insurance, lease costs, utility bills, inventory costs, recurring permit and licensing fees, property tax, and salaries.You likely pay a monthly or annual fee for your business website domain and e-commerce hosting if you sell items online. These costs don’t change based on sales volume and are therefore fixed. · Whether you own or rent, you may have to include property taxes within your total expenses.A fixed cost remains unchanged no matter how much product is produced and sold, while a variable cost varies in proportion to changes in your business activity. When the amount of product you produce increases, variable costs increase too. · Some examples of variable expenses include raw materials, delivery costs, sales commissions, wages for part-time staff, taxes, and operational expenses.

What I am calling a“fixed tax” is simply charging every citizen and resident, who enjoys the benefits of living in the country, the same amount each year, say somewhere in the range of 0 to 5,000… What I am calling a“fixed tax” is simply charging every citizen and resident, who enjoys the benefits of living in the country, the same amount each year, say somewhere in the range of 0 to 5,000 dollars.On paper, this is perhaps the most regressive tax ever suggested. Poor or rich, black or white, male or female, all pay the same amount. To understand why a fixed tax would work better than income taxes, we’ll start with an overview of how money works.These benefit payments are called “interest”. Cash allows currency holders to spend their money with anyone subject to the political authority of the tax collector. To understand why a fixed or equal tax would work much better than the federal income tax, we will now discuss the design of taxes.What I am calling a“fixed tax” is simply charging every citizen and resident, who enjoys the benefits of living in the country, the same…

For tax years beginning on or after January 1, 2015, a new corporate tax applies to corporations and banks, other than federal S-corporations, that do business in New York City. Starting in 2022, corporations that derive receipts of $1 million or more are also subject to tax. Small businesses qualify depending on their level of income. Financial corporations are corporations, or combined groups that meet the definition set forth in Administrative Code section 11-654(1)(e)(1)(i). Business Capital Base Tax Rates · Fixed Dollar Minimum (FDM) Amounts ·The Department of Finance (DOF) is in the process of developing regulations for the business corporation tax, enacted in 2015. On December 27, 2023, the New York State Department of Taxation and Finance published a new set of regulations for the New York State corporate tax.In order to receive tax practitioners’ and policy advocates’ perspectives, DOF conducted two public virtual discussion sessions on May 14th and May 15th, 2024, and received comments both in writing and at the sessions themselves.For tax years beginning on or after January 1, 2022, the Administrative Code now provides that corporations deriving receipts of $1 million or more from New York City sources will be subject to the business corporation tax.

Discover the Tax Services Operations Officer/Analyst (M/F) - Fixed-term contract until end of December 2025 job ad at Luxembourg (Canton), Luxembourg, and apply online! The company Banque Internationale à Luxembourg (BIL) is currently recruiting. Permanent contract job tax advisor in Luxembourg.Mise en place et suivi opérationnel des différents services fiscaux et des reportings réglementaires (PFS, Tax Reports, Tax Relief et Tax Reclaim , FATCA, CRS)

Fixed Deposits (FDs) are one of the most preferred investment options in India for their safety and assured returns. However, many investors forget that the interest earned on FDs is fully taxable. Discover how FD interest is taxed in India and ways to avoid TDS by submitting Form 15G/15H if your income is below the taxable limit.Taxable under "Income from Other Sources" in Income Tax Return (ITR).Added to the total income and taxed as per the applicable income tax slab.The TDS deduction can be avoided by submitting Form 15G/15H (if your total income is below taxable limit).

A flat tax system applies the same percentage income tax to all taxpayers regardless of their income. A flat tax is a single percentage income tax rate applied to all taxpayers regardless of income.A flat tax rate eliminates all deductions and exemptions.Most flat tax systems do not tax income from capital gains, dividends, distributions, or other investments.The opposite of a flax tax is a progressive tax, in which the rate of taxation rises with a taxpayer's income.

:max_bytes(150000):strip_icc()/GettyImages-985109526-3988df95090d45e19479d3da15ed964e.jpg)

Eaton Vance Municipal Bond Fund's Tender Offer: A Strategic Indicator for Tax-Exempt Fixed Income Opportunities For investors seeking tax-exempt fixed income opportunities, EIM’s tender offer highlights two key insights. First, the narrowing of its discount to NAV—currently around 5%—presents a more attractive entry point compared to peers with wider discounts.EIM employs residual interest bond financing to boost tax-exempt income, a tactic that contributed to its 15.31% annualized return at NAV for the 12 months ending September 30, 2024—outperforming the Bloomberg Municipal Bond Index’s 10.37% [3]. Leverage, however, is a double-edged sword.By reducing its share count and signaling confidence in its NAV, the fund aims to narrow its discount while maintaining its leverage-driven edge in a challenging municipal bond market. For investors, this move underscores the importance of monitoring CEF discounts and leverage ratios as key indicators of value in the tax-exempt space.- Narrowing discounts and leverage ratios signal value for tax-exempt investors amid yield curve shifts.

A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum ... Modified flat taxes have been proposed which would allow deductions for a very few items, while still eliminating the vast majority of existing deductions. Charitable deductions and home mortgage interest are the most discussed examples of deductions that would be retained, as these deductions are popular with voters and are often used. Another common theme is a single, large, fixed deduction.This large fixed deduction would compensate for the elimination of various existing deductions and would simplify taxes, having the side-effect that many (mostly low income) households will not have to file tax returns.New Hampshire introduced a flat tax on interest and dividends in 1923, at the average property tax rate imposed by municipalities in the state. The rate was fixed at 4.25% in 1956, changed to 5% in 1977, 4% in 2023, 3% in 2024, and the tax was repealed in 2025.A flat tax (short for flat-rate tax) is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount.There are various tax systems that are labeled "flat tax" even though they are significantly different.

Regressive taxes include property taxes, sales taxes on goods, and excise taxes on consumables such as gasoline, airfare, tobacco products, and alcohol. Excise taxes are often indirect taxes. They're fixed and included in the price of a product or service. Individual taxpayers pay a set percentage of annual income regardless of how much they earn under a proportional income tax system. The fixed rate doesn't increase or decrease as income rises or falls. An individual who earns $25,000 annually would pay $1,250 in tax at a 5% rate.The U.S. uses three types of tax systems: regressive, proportional, and progressive. Two impact high-and low-income earners differently and one is the same for all.Tax systems in the U.S. fall into three categories: regressive, proportional, or progressive. Regressive and progressive taxes impact high- and low-income earners differently but proportional taxes don't. Property taxes are an example of a regressive tax. The U.S. federal income tax is progressive.Taxes can also be classified as indirect or direct taxes. Indirect taxes such as some excise taxes are incurred by a manufacturer or supplier and then passed on to consumers. They're tacked on to what a consumer pays for a given product. Income taxes are direct taxes.

The personal allowance for income tax is set at £12,570 for 2024/25. Like the basic rate limit, the personal allowance has been fixed in value since 2021/22. The 2024/25 financial year began on 6 April 2024. The direct tax rates and principal tax allowances for this year were confirmed in the 2024 Spring Budget.Direct taxes are paid directly by the taxpayer to the government. For individuals, the main direct taxes in the UK are income tax and National Insurance contributions. Indirect taxes are collected by another party – such as a retailer or a producer – and then paid to the government.The main indirect taxes in the UK are VAT and excise duties, charged on alcohol, tobacco, and road fuel.This briefing sets out direct tax rates and principal tax allowances for the 2024/25 tax year.

Lengardary animator Genndy Tartokovsky finished making 'Fixed' two years ago, but almost became the next 'Coyote vs Acme' Warner Bros tax write off. It was the message all WB filmmakers have learned to dread in the wake of Warner Bros. chief David Zaslav starting to shelve films for tax reasons. The company’s strategy of intentionally taking a financial loss it could write-off against its seemingly insurmountable debt, had made martyrs of “Batgirl,” the Scooby-Doo sequel “Scoob! Holiday Haunt,” as well as “Coyote vs Acme,” and Tartakovsky assumed “Fixed” would be the next victim.Brener’s solution was to give the film back to Sony. Tartakovsky believed Sony initially walked away from “Fixed” at the script phase because they couldn’t envision the R-rated comedy, but now that it was completed and screening well, he had faith they would distribute the film.Tartakovsky tried to get into the minds of potential distributors. At one point, he even proposed to Sony that he would rent theaters with his own money, give “Fixed” a limited three-month release, if, once it got traction, Sony would agree to give it a wider release.In January of this year, one year after having initially passed, Sony delivered word Netflix was looking to buy “Fixed.” John Derderian, the head of Netflix adult animation, had seen and loved the movie, and according to Tartakovsky, has done everything to champion the film heading into its release on Netflix.

FIXED TAX meaning: a tax that is charged at the same rate on everyone or everything, whatever their income, profit…. Learn more. He receives the fixed tax provided in the original agreement.The chief vassals who were unwilling to join the army were allowed to pay a fixed tax or "scutage" instead of giving their personal service.The brokers were paid by a fixed tax on the merchants' goods which passed through their hands.There is a fixed tax, and no one is allowed to charge more, or to oppress the people in any way.

Hi there Community Hubbers, We have Sage Fixed Assets customers who love using our solution for depreciation. But, managing fixed assets is about more than just Available 24/7, the Forums are a great place to ask and answer product questions, as well as share tips and tricks with Sage peers, partners, and pros. Announcements The hidden costs of fixed asset mismanagement—tax and compliance advantages to maximize your ROIWe have Sage Fixed Assets customers who love using our solution for depreciation. But, managing fixed assets is about more than just tracking depreciation, right? If your business is looking to optimize tax compliance, minimize financial risk, and reduce all those hidden costs of poor asset management, give this a quick read.WP - Maximize ROI - Tax and Compliance Advantage.pdf

Theme 3: Fairness in TaxesLesson 4: Proportional Taxes · tell us what you think

The interest earned is taxable as per the investor's tax bracket. The interest on deposits is payable on either monthly/quarterly basis or can be reinvested. According to current income tax laws, if an individual opts for old/existing tax regime, then under Section 80C of the Income-tax Act, you can claim deduction for investments up to Rs 1.5 lakh in a financial year by investing in tax-saving fixed deposits (FDs).4. A person can invest in these FD's through any public or private sector bank except for co-operative and rural banks. 5. Investment in Post Office Time Deposit of 5 years also qualifies for deduction under section 80 (C) of the Income Tax Act, 1961. 6. Post Office Fixed deposit can be transferred from one post office to another.Income tax saving fixed deposit rates: Here are the top 5 tax saving bank FD interest ratesThe amount so invested is to be deducted from gross total income to arrive at the net taxable income. This benefit is not available for someone who opts for the new tax regime.

The tax on capital is limited to $5,000,000 for general business taxpayers. The fixed dollar minimum tax is determined by the corporation's New York State receipts. The tax rates and fixed dollar minimum tax amounts provided on this page are for New York C Corporations only.The current amounts of the fixed dollar minimum tax are as follows:The business income base equals federal taxable income, modified for items of income and deduction that New York treats differently, minus investment income and other exempt income, that is apportioned to New York State.The business capital base is the total business capital apportioned to New York State after deducting short-term and long-term liabilities attributable to assets. The current tax rates for business capital are as follows:

A flat tax refers to a tax system where a single tax rate is applied to all levels of income. This means that individuals with a low income Let’s assume that Peter, James, and John work at the same manufacturing company in Russia. Peter works as a technician and earns an annual taxable income of $40,000. James works as an accountant, and he earns an annual taxable income of $60,000. John works as the chief ICT officer, and he earns an annual taxable income of $80,000.In 2016, US Senator and presidential candidate Ted Cruz proposed the adoption of a 10% flat tax rate in the US. If implemented, the tax system would exempt a family of four with an income below $36,000 from paying taxes.The flat tax system would also eliminate the estate tax, Obamacare taxes, as well as the Alternative Minimum Tax. The tax proposal would also reduce corporate taxes to 16%, while profits earned abroad would be tax-free.This means that individuals with a low income are taxed at the same rate as individuals with a high income.

The first quarter saw rates decline across the yield curve, benefiting fixed income returns broadly. However, the yield curve steepened during the second quarter, as longer-term rates increased, largely in response to anticipated growth in the U.S. fiscal deficit due to the tax and spending ... The first quarter saw rates decline across the yield curve, benefiting fixed income returns broadly. However, the yield curve steepened during the second quarter, as longer-term rates increased, largely in response to anticipated growth in the U.S. fiscal deficit due to the tax and spending legislation under congressional consideration.We like well-diversified multisector and core plus bond strategies in particular. Learn more with Nuveen.Preferred securities offer attractive, tax-advantaged yields. Banks and insurance companies (the largest issuers of preferreds) continue to exhibit healthy underlying fundamentals and are less directly affected by the tariffs.As global trade tensions persist and economic growth moderates, fixed income markets face both challenges and opportunities. While tariff-related uncertainty continues to weigh on growth prospects, historically attractive yield levels across fixed income sectors offer compelling entry points for investors.